It’s the most wonderful time of the Year!

As Andy Williams once sung- It’s the most wonderful time of the year! Yes – but it’s not Christmas it’s the business awards season!

I’ve been busy judging, presenting and attending awards this autumn.

Amongst these have been Made in South East Manufacturing Awards, the Make UK Regional Awards and the “Dealmakers of the Year’ awards also for the South East.

I’ve previously judged the IoD Director of the Year Awards, presented the National Awards and even delivered speeches.

I would wholeheartedly recommend getting involved in awards judging as I always find it interesting to learn about who companies have resolved a wide range of business issues and how they have used professional help.

Of course it goes without saying that I’m a great advocate of entering competitions, there are a whole range of different awards and some ideally fit the business you work in.

Back in Parliament

I was recently back in Parliament to support the launch of Manufacturing Commission’s new inquiry: Upskilling Industry, Manufacturing Productivity and Growth in England. The report explores the reasons for the skills gap in UK manufacturing and makes recommendations to Government on how businesses can best navigate recent reforms to the skills system.

The inquiry explored the challenges of upskilling the manufacturing workforce and how recent further education reform can be best navigated by businesses, education providers, and individuals.

Drawing on evidence from Parliamentarians, civil servants, academics, and industry stakeholders, Upskilling Industry calls for the UK Government to provide greater support for businesses in the manufacturing sector.

With thanks to our inquiry Chair, Lord Karan Bilimoria, and vice-Chairs, Mark Pawsey MP and Sarah Olney MP and to Rob Allen for all of his hard work

You can read the report here: https://lnkd.in/e8jjbD_f

Visit to Popham Airfield

I had the good fortune recently to visit a long standing friend and former colleague Mike Pearson who’s the Airfield Manager at Popham and also happens to be the General Aviation Advocate at the Department of Transport – big cheese looking after the interests of all involved in the industry. After a very interesting conversation about what’s going on in the world of general aviation and also remotely piloted aircraft such as drones, Mike showed me around some of the exotica around the airfield. Some of the pictures are not quite what they seem! Also for an avid Autogyro fan. think of James Bond in ‘You only live twice’, there were some shining examples- I was even offered a ride at a later date!

It’s really impressive to see so much going on at the site with lots of events being held (including an open day on the 16th April) , a moto-cross track at the far end of the runway and lots of facilities for those involved in flying light aircraft including many storage hangars. There were even some Beagle Pups there which I got involved with in my days at British Aerospace!

Merry Christmas and a Happy New Year

A donation has been made to Oakleaf Enterprise. Helping those in need at this difficult time of the year

Birthday celebrations- Final update

UPDATE 30th May 2022

Well I did it!

So pleased to have completed Ride London for Oakleaf

My fundraising has gone well but more contributions are always gratefully received on my Just Giving page. Just ten pounds will pay for a counselling session for someone in need to please help if you can.

The ride itself was interesting and much tougher than I expected. Where I live it’s very hilly with hardly any flat ground around at all. This means for every climb there’s usually a descent to rest and recuperate.

This ride on the softly undulating landscape of Essex was full power all of the way with no respite. Interestingly the heart rate stayed in a defined range as did the power output. The Northerly wind against for the first 50 miles was also a challenge plus a few gusty side winds too.

On the top cog throughout but the shoulder (see below) certainly gave me a constant reminder of what happened a few years ago.

The ride itself was quite congested. I saw the aftermath of at least 8 accidents and there were a few close calls in the congested areas with some overenthusiastic riding by a few. We were also delayed while some poor soul was evacuated away by helicopter, I hope they are ok.

So that’s the second Ride London done for me and maybe the last!

At the moment I never want to eat another energy bar again (being diabetic controlled by diet doesn’t help!)

Many thanks to all of those who have encouraged me, my family for putting up with the training rides and those who have supported my charitable efforts!

UPDATE 12th May 2022

As this week is Mental Health Awareness week and I am supporting local charity Oakleaf , I thought I’d update on my training for the ride with just over two weeks to go – full details are on my Just Giving page. The birthday is now out of the way by the way!

I’ve been getting a few miles in which you will see on my just giving page, trying to average over 70 miles a week. I even snuck in a crafty, albeit slow, ride in Amsterdam last week on a long weekend break. It wasn’t easy to find any hills to climb apart from the bridges but the hefty bike made it hard work.

I’ll be doing the Kelly’s 50 miler on the 22nd as my final big prep ride. The next report will hopefully be after I have completed the ride

If any other friends and colleagues are doing the ride drop me a line with your start time when you get it. Always nice to have some company in a crowd of 25000!

Cheers

David

Every year 1 in 4 people will suffer from a mental health issue

The Covid-19 pandemic has had an enormous impact on the mental health and wellbeing of UK adults, and those who were already struggling have been disproportionately impacted.

The uncertainty and stress caused by the war in Ukraine, which must be unbearable for those closely involved, is only adding to this.

In 2018/19, stress, depression or anxiety were responsible for 44% of all cases of work-related ill health and 54% of all working days lost due to health issues in GB

People with mental health needs have the second lowest employment rate of any disabled group with only 28.5% securing long-term work, and those with mental ill-health are more vulnerable to the negative effects of unemployment

Some people do recover, they respond well to treatment and medication without too much damage to their emotional, social and working life.

So this year I’m cycling the new 100mile Ride London route into darkest Essex – truly a trip into the unknown for me!

I’m doing it to raise money for Oakleaf Enterprise and my Just Giving link is here

Oakleaf exists to help people who are less fortunate and find their road to recovery more difficult to achieve. Finding and keeping a job is an important aspect of the recovery process and ensuring the right support is vital.

With the help of friends and family we managed to raise well over £2000 for Oakleaf.

I decided that I would do it again on or around my 60th birthday so here we are.

Two and a half years ago, just before lockdown, I had the misfortune to crash my Mountain Bike at high speed

After a repair and consequential removal of the metalwork, days before the virus took hold, I was back on my bike within 5 months of the accident.

A huge thank you to the team at Frimley Park Hospital for fixing me and some fantastic rehabilitation physio. (I’m not such a bold descender these days)

Donating through JustGiving is simple, fast and totally secure. Your details are safe with JustGiving – they’ll never sell them on or send unwanted emails. Once you donate, they’ll send your money directly to the charity. So it’s the most efficient way to donate – saving time and cutting costs for the charity.

Thank you for your support and here is the link once again

Merry Christmas Everyone

As we seem to be stuck in a bit of a ‘Groundhog day’ situation I thought I would re-issue last year’s card – the message still stands unfortunately

A donation has been made to Oakleaf Enterprise Open at Christmas and the New Year to help those in need.

Visit to Pilgrim Motorsports

A great day out for the automotive enthusiast at Pilgrim Motorsports. Many thanks to MD Paul Bennett for hosting it and Rupert Rawcliffe for inviting me.

So many great cars in various states of restoration or new build!

It was interesting to talk about the future for such classic cars which on the surface can be ‘gas guzzlers’ but in reality typically do very low mileages and actually use easily recyclable materials in their construction.

Synthetic fuels and electrification may be the saviour for such iconic cars. I’m convinced that my own classic will carry on life with an electric conversion and the engine as a coffee table!

https://www.footmanjames.co.uk/blog/eco-friendly-classic-cars

https://classicsworld.co.uk/news/synthetic-fuel-a-new-hope-for-classics/

https://www.bbc.co.uk/news/business-58578061

Author!

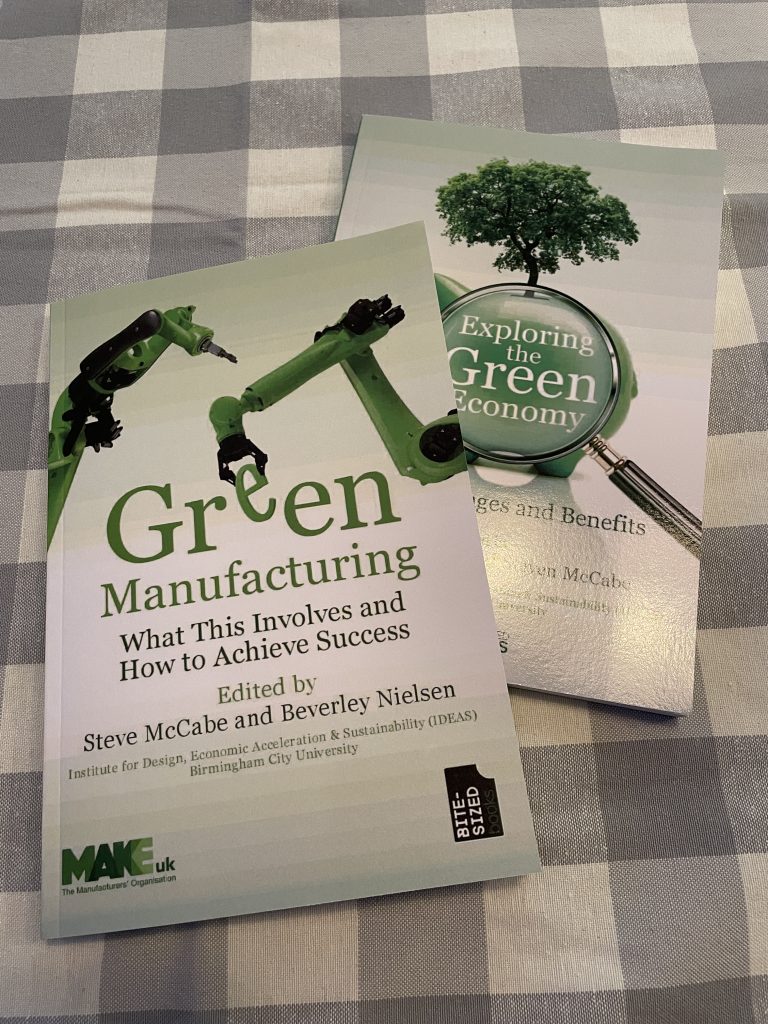

Delighted and honoured to have been asked to write a chapter for a book published recently and especially pleased to be alongside contributions from authors such as Vicky Pryce, Sir Jonathan Porritt and Tony Juniper. Many thanks to the editors Beverley Nielsen and Steven McCabe for inviting me to take part. The book is available here

Following this I was delighted to attend the launch of the book ‘Green Manufacturing: What this involves and how to achieve success’ today’. A big thank you to Beverley Nielsen and Dr. Steven McCabe for inviting me to contribute a chapter to the book. It was an interesting debate with some great contributions from manufacturers and policy makers. This book is available here

University graduation ceremony

A great day being asked to be the keynote speaker at the University of Surrey Graduation ceremony.

Congratulations to all of the graduands.

For those brave enough, the speech can be seen here https://www.youtube.com/watch?v=iXpymGrTgk4&t=2528s

Technology adoption – do our habits hold us back?

Everyday we see a new technology coming to light that will influence our everyday lives. At the moment it seems to involve a plethora of new electric vehicles each with more intelligence (nearly always not AI) and a more efficient remedy to ‘range anxiety’.

Bubbling along are developments in domestic heating which will significantly accelerate the drive to zero emissions and further enhancements to e-bike capability.

It seems that mobile phones and other IT hardware have plateaued and all we now see are incremental improvements or faddish ideas.

If, like me, you are more of an early follower than adopter, there’s always the niggling doubt that you might choose the wrong option. I loved my Betamax video recorder but was glad that I didn’t choose a 3D television.

When I look around the house I see lots of stuff that is yesterday’s tech. A television aerial on the roof, a can of petrol for the lawnmower in the shed, a bookcase full of CDs and DVDs including Blu Rays and to pay for this stuff, a cheque book or even cash.

Clinging on to this takes up space and it’s probably never going to be an antique (didn’t mention the VHS recorder in the attic). In some cases it holds one back using new tech as there’s the sense of maximising the value from what you have.

Of course in emerging economies there isn’t this choice. Those of us that had the old SKY TV satellite dish for the Astra satellite in the early 90s will remember that it was populated with German TV channels. The reason for this was that the SES / Astra platform was supported by the German government to find a quick and simple way to upgrade broadcasting systems after the fall of the Berlin Wall and the demise of the DDR. They missed out expensive upgrades to land based stations and went straight to satellite.

In parts of Africa the first real bank accounts customers have had have been provided by mobile phone tech. Customers can pay for things and transfer cash balances, they have never used a bank branch or cheque book.

Of course in China, platforms such as WeChat have revolutionised payment systems.

The UK is somewhere along the curve with all of these emerging technologies with a mix of early adopters but also a significant percentage of tech sceptics who see no reason to change or even actively resent it and see it as an invasion and assault on their values. I do have a relative with a fax machine (they don’t get sent many).

With our infrastructure tied up with servicing old tech, as well as attempting to integrate the new, we start to lag behind the emerging economies. Just look at the outrage when a bank (remember these are commercial entities and not institutions) decides to close a branch in a small town or village which is no longer viable. The main protests come from those who don’t internet bank. I do acknowledge the proportion of the population that its excluded from tech adoption through perhaps disability or poverty but they aren’t usually the ones writing to the local newspaper. Oh yes, that’s another industry that technology has overwhelmed.

The danger of all this, is that the mindset spreads and UK industry starts to lag behind the rest of the world through the adoptions of new technology, either through lack of investment, sometimes driven by not wanting to take on any debt or more worryingly a risk avoidance view that what they have currently is good enough.

The fourth industrial revolution, Industry 4.0, demands a new way of thinking and old legacy systems will simply not “plug and play”. Companies which do not invest will find themselves excluded from fully digital supply chains. It’s a high risk investing in technology that may be quickly superseded or available at a much lower price if a purchase is delayed but it’s essential that businesses are at least early followers if not early adopters in order to remain globally competitive.

Now after all that it’s time to warm up the amp and put some vinyl on the turntable……..

Recent Comments